Commodity Monthly Analysis

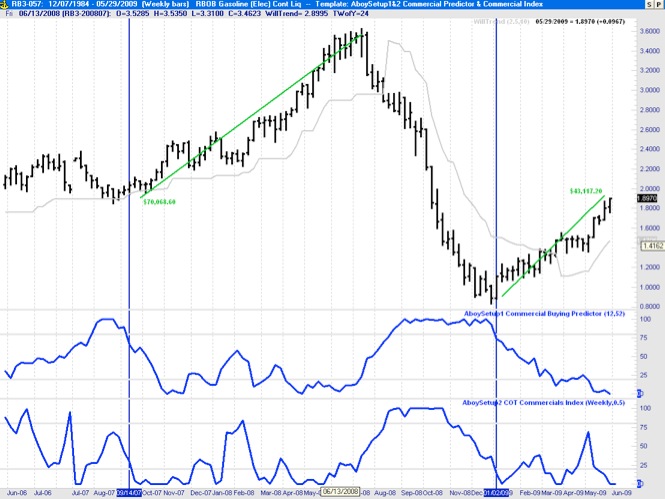

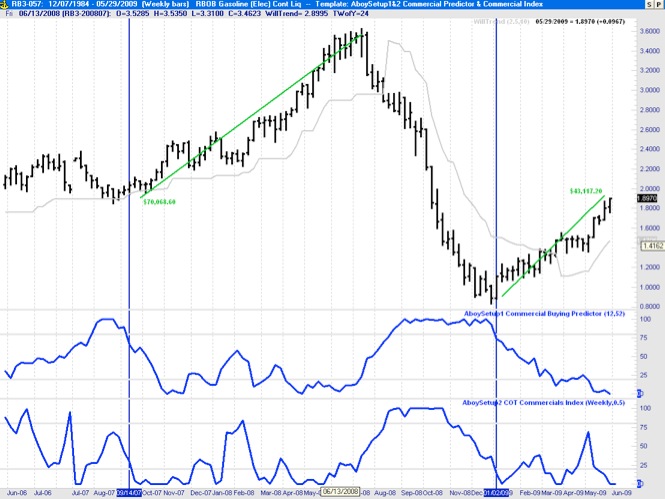

Setup Conditions for RBOB Gasoline

May/31/2009 23:31

The chart below shows the price time series for RBOB Gasoline and two indicators, namely, the AboySetup1 Commercial Buying Predictor (i.e. a proxy for the COT proxy indicator) and the actual COT commercial index based on the commercial data. As we had already mentioned in previous posts, good setup conditions for long entry correspond to values greater than 80% in these indicators.

While these indicators are not intended to be used as entry techniques (e.g. once the setup condition is met other entry techniques can be used to obtain better results), a rough estimate for the long entry point occurs when AboySetup1 crosses the 80% line downward. The last two times this condition was met it resulted in gains of over $70,000 and $43,000 per contract, respectively.

Note also that the commercials are out of the market right now. We need to watch out for a possible correction/reversal downwards.

While these indicators are not intended to be used as entry techniques (e.g. once the setup condition is met other entry techniques can be used to obtain better results), a rough estimate for the long entry point occurs when AboySetup1 crosses the 80% line downward. The last two times this condition was met it resulted in gains of over $70,000 and $43,000 per contract, respectively.

Note also that the commercials are out of the market right now. We need to watch out for a possible correction/reversal downwards.

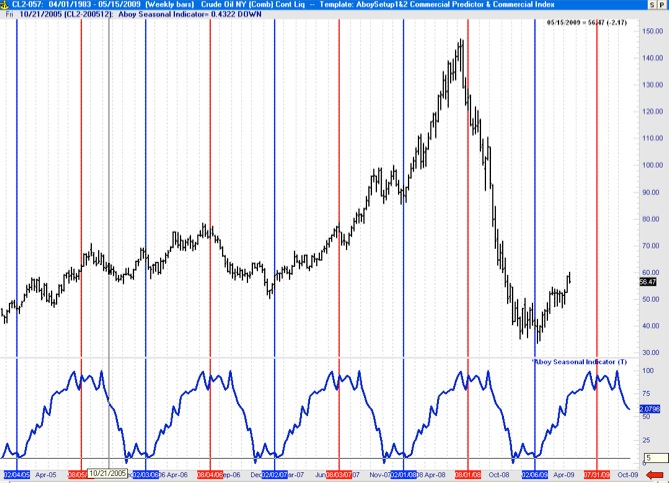

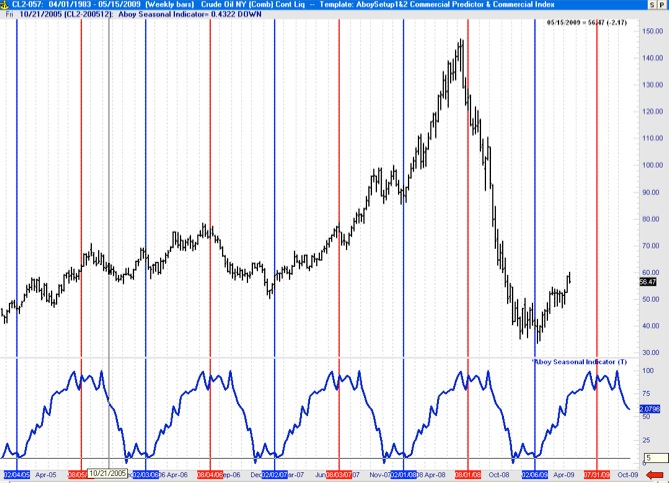

Seasonal Analysis of Crude Oil

May/16/2009 14:15

Below a show the results of my study on seasonal tendencies of crude oil (Crude Oil NY). The chart shows the price of crude oil from March 2005 to May 2009 (top plot) and the associated Aboy Seasonal Indicator developed from the daily crude oil time series from 1990 to 2007 (bottom plot in blue). As shown below there are strong seasonal tendencies is this energy commodity. Crude oil yearly lows typically occur around the first week of February and market highs around the last week of July and first week of August.

Follow-up on previous setups (Gold)

May/09/2009 14:04

In my February 1st, 2009 commentary (Setup Condition for Gold) I stated that “Gold has good fundamental conditions for going SHORT [...] while the trend is bullish, Gold is setup for a big sell.” This was a very contrarian view at the time due to the economic situation but as the chart shows below between February 1st and May 8th, 2009 gold went down around $8000 per contract. Those that went short made over $8000 per $2025.00 contract.

Setup Condition for Cocoa (March 09 W1)

March/01/2009 20:46

Cocoa has good fundamental setup conditions for going SHORT. See weekly chart below. The commercial index and commercial estimator reached minimum levels last week while small-traders, large-traders, and sentiment were reaching maximum levels. We could have entered short already and it is still a valid entry.

Setup Condition for Gold (February 09 W1)

February/01/2009 22:53

Gold has good fundamental setup conditions for going SHORT. See weekly chart below.

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: very low <10%

-AboySetup2 Commercials Index: very low <10%

-AboySetup3 Sentiment Index: high < 80%

-AboySetup4 Large Traders Index: very high > 90%

-AboySetup5 Small Traders Index: high > 60%

-AboySetup6 Fundamental Valuation Index : overvalued

-AboySetup7 Seasonal: around the highest point to buy

-Stochastic: overbought >80%

-ADX: decreases

Analysis:

-While the trend is bullish, Gold is setup for a big sell. Given the economic situation people is buying Gold (they think this is a good idea given the uncertainty in the dollar, etc). Sentiment is very high (i.e. brokerage newsletters, brokers, etc are recommending buying gold). Note, however, that the commercials are completely out of the market. It may take a few weeks but we need to be ready for SHORT entries.

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: very low <10%

-AboySetup2 Commercials Index: very low <10%

-AboySetup3 Sentiment Index: high < 80%

-AboySetup4 Large Traders Index: very high > 90%

-AboySetup5 Small Traders Index: high > 60%

-AboySetup6 Fundamental Valuation Index : overvalued

-AboySetup7 Seasonal: around the highest point to buy

-Stochastic: overbought >80%

-ADX: decreases

Analysis:

-While the trend is bullish, Gold is setup for a big sell. Given the economic situation people is buying Gold (they think this is a good idea given the uncertainty in the dollar, etc). Sentiment is very high (i.e. brokerage newsletters, brokers, etc are recommending buying gold). Note, however, that the commercials are completely out of the market. It may take a few weeks but we need to be ready for SHORT entries.

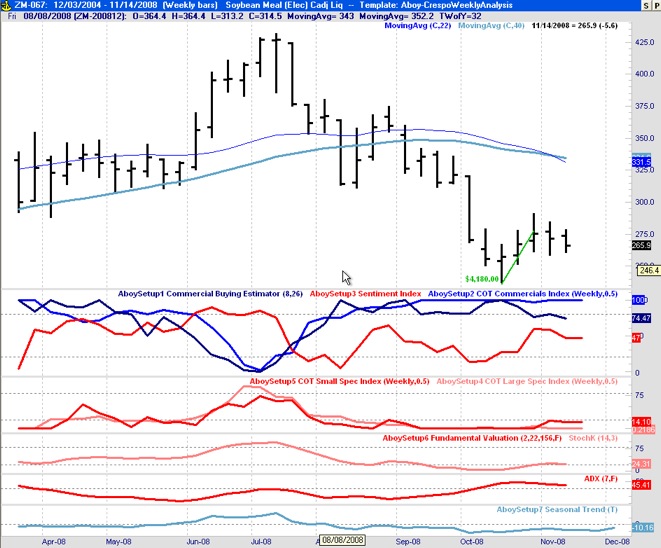

Follow-up on previous setups (Soybean Meal)

February/01/2009 22:33

Below is the follow-up results of my analysis of the setup conditions and entry for Soybean Meal (November W3). It amounts to $9,270.00 per contract. Note that one contract of Soybean Meal only requires a margin of $743.00. This is an outstanding return!

Follow-up on previous setups (Coffee)

February/01/2009 22:30

Below is the follow-up results of my analysis of the setup conditions and entry for Coffee (November W2). It amounts to $8,025.00 per contract. Note that one contract of Coffee only requires a margin of $1,680.00. This is an outstanding return!

Setup Conditions for Corn (December)

December/07/2008 22:21

Corn has good fundamental setup conditions. See weekly chart below.

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: high

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: low < 25%

-AboySetup4 Large Traders Index: low > 20%

-AboySetup5 Small Traders Index: high < 80%

-AboySetup6 Fundamental Valuation Index : low < 25%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: over 60

Analysis:

-Long Entry requires closings above 370. The overall trend is bearish.

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: high

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: low < 25%

-AboySetup4 Large Traders Index: low > 20%

-AboySetup5 Small Traders Index: high < 80%

-AboySetup6 Fundamental Valuation Index : low < 25%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: over 60

Analysis:

-Long Entry requires closings above 370. The overall trend is bearish.

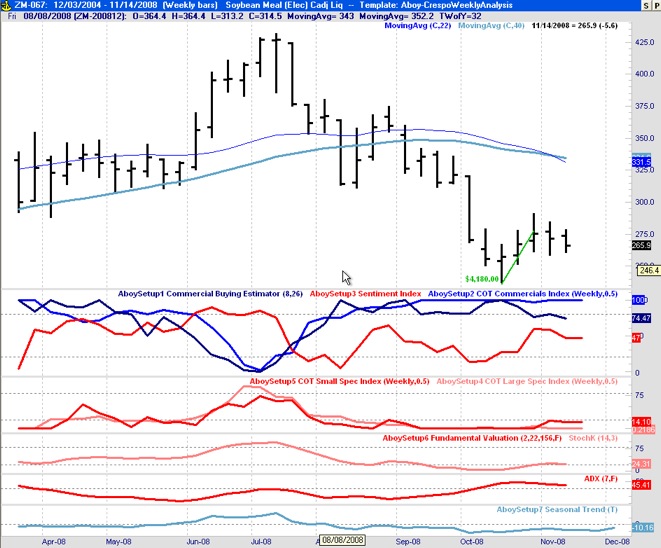

Setup Condition for Soybean Meal (November W3)

November/16/2008 21:55

Soybean Meal has good fundamental setup conditions and is ready for entry again. See weekly chart below.

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: high & decreasing

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: moderate/low < 50%

-AboySetup4 Large Traders Index: low <20%

-AboySetup5 Small Traders Index: moderate < 35%

-AboySetup6 Fundamental Valuation Index : normal < 55%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: maximum reached

Analysis/Action:

Entry: Long Stop 269.30; Stop 260.00 (see daily chart below)

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: high & decreasing

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: moderate/low < 50%

-AboySetup4 Large Traders Index: low <20%

-AboySetup5 Small Traders Index: moderate < 35%

-AboySetup6 Fundamental Valuation Index : normal < 55%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: maximum reached

Analysis/Action:

Entry: Long Stop 269.30; Stop 260.00 (see daily chart below)

Setup Condition for Coffee (November W2)

November/09/2008 20:33

Coffee has good fundamental setup conditions and is ready for entry. See chart below.

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: high >80%

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: moderate/low < 50%

-AboySetup4 Large Traders Index: low <20%

-AboySetup5 Small Traders Index: moderate < 35%

-AboySetup6 Fundamental Valuation Index : normal < 55%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: maximum reached

Analysis/Action:

Entry: Long Stop 117.10; Stop 112.65

Conditions Summary:

-AboySetup1 Commercial Buying Estimator: high >80%

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: moderate/low < 50%

-AboySetup4 Large Traders Index: low <20%

-AboySetup5 Small Traders Index: moderate < 35%

-AboySetup6 Fundamental Valuation Index : normal < 55%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: maximum reached

Analysis/Action:

Entry: Long Stop 117.10; Stop 112.65

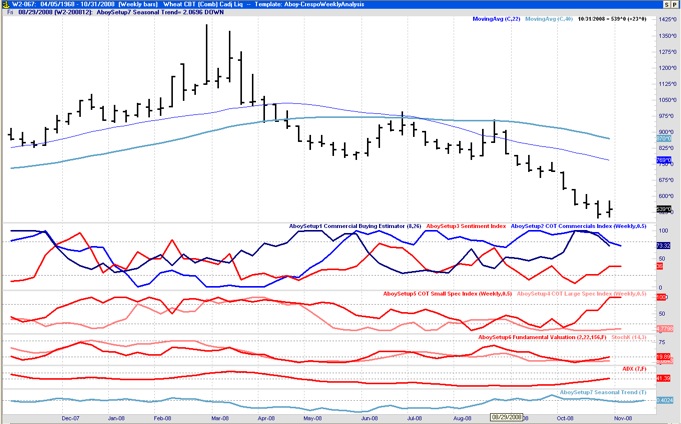

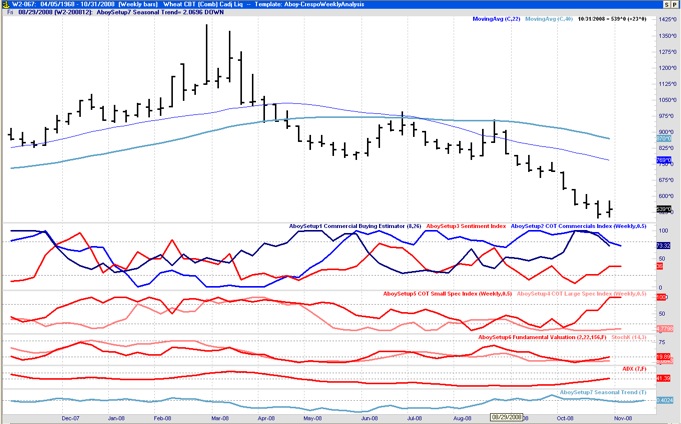

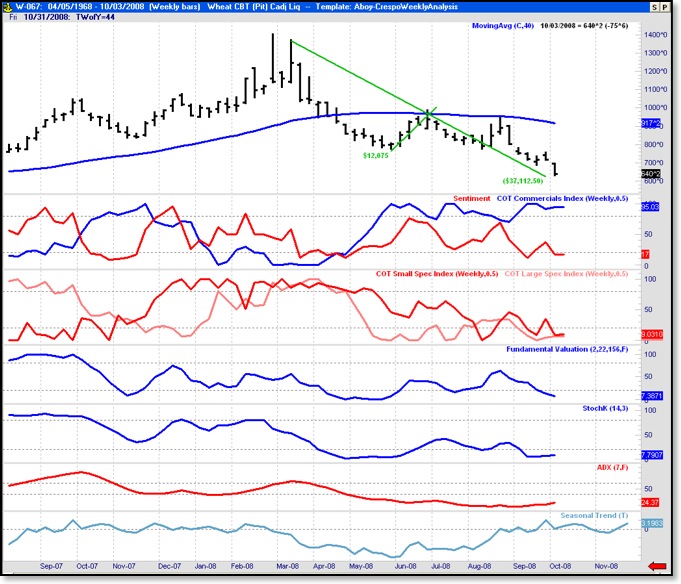

Setup Condition for Wheat (November 08 W1)

November/02/2008 20:53

Below is an update for the Setup Condition for Wheat.

Conditions:

-The setup conditions were evaluated last month. Below is an updated chart.

Analysis:

-It looks like the time is right for entry in this commodity. Our entry techniques indicate to buy long on a stop at 546^6. Stop is 517.00.

Conditions:

-The setup conditions were evaluated last month. Below is an updated chart.

Analysis:

-It looks like the time is right for entry in this commodity. Our entry techniques indicate to buy long on a stop at 546^6. Stop is 517.00.

Follow-up on previous setups

November/02/2008 20:44

Below are the results for Soybean Meal. Note that $4,180.00 were made per contract since the original posting of the setup condition. Copper did not met the requirements specified.

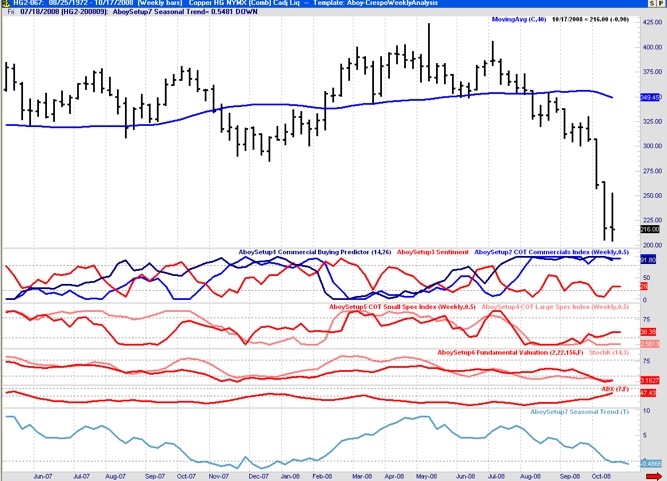

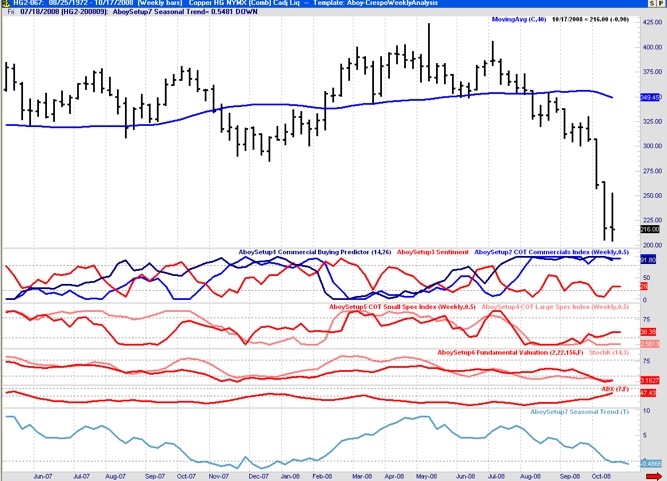

Setup Condition for Copper (October 08 W4)

October/19/2008 20:51

In the Metal commodities Copper shows good setup conditions this week:

Conditions:

-AboySetup1 Commercial Buying Estimator: high >80%

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: low < 20%

-AboySetup4 Large Traders Index: low <20%

-AboySetup5 Small Traders Index: moderate < 35%

-AboySetup6 Fundamental Valuation Index : undervalued <20%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: still waiting for a maximum and reversal

Analysis:

-Copper has good setup conditions. The specific entry technique depends on the system used and the tolerance for risk. Buying long would require the price to move above of 223.70 (i.e. buy long on stop at 223.70) with a stop at 205.50.

Conditions:

-AboySetup1 Commercial Buying Estimator: high >80%

-AboySetup2 Commercials Index: high > 80%

-AboySetup3 Sentiment Index: low < 20%

-AboySetup4 Large Traders Index: low <20%

-AboySetup5 Small Traders Index: moderate < 35%

-AboySetup6 Fundamental Valuation Index : undervalued <20%

-AboySetup7 Seasonal: around the lowest points

-Stochastic: oversold <20%

-ADX: still waiting for a maximum and reversal

Analysis:

-Copper has good setup conditions. The specific entry technique depends on the system used and the tolerance for risk. Buying long would require the price to move above of 223.70 (i.e. buy long on stop at 223.70) with a stop at 205.50.

Follow-up on previous week setups

October/19/2008 19:52

Last week we analyzed the setup conditions for Soybean Meal. The cost of 1 contract for this commodity is $743.00. The price increase from Thursday to Friday was $1590.00 (per contract). This commodity still has all the setup conditions to keep increasing.

The previous analysis (W2) of setup conditions is still valid.

The previous analysis (W2) of setup conditions is still valid.

Setup Condition for Soybean Meal (October 03 W3)

October/12/2008 20:07

Soybean Meal shows good setup conditions this week:

Conditions:

-Commercials: high > 80%

-Sentiment: low < 20%

-Large Traders: low <20%

-Small Traders: low < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: uptrend

-ADX: still waiting for a maximum and reversal

Analysis:

-As was the case last week (W2) there are several commodities that are developing good setup conditions. Most commodities are on a downtrend due to the overall economic environment. It is important to note, however, that many of them have been significantly oversold since Spring/Summer 08, they are currently undervalued, sentiment is very low, but users (commercial users) of natural commodities are aggressively buying. These are perfect setup conditions and opportunities to enter long assuming the proper entry conditions are also met (in addition to the setup conditions). For now, we are still waiting to see what happens this week.

Conditions:

-Commercials: high > 80%

-Sentiment: low < 20%

-Large Traders: low <20%

-Small Traders: low < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: uptrend

-ADX: still waiting for a maximum and reversal

Analysis:

-As was the case last week (W2) there are several commodities that are developing good setup conditions. Most commodities are on a downtrend due to the overall economic environment. It is important to note, however, that many of them have been significantly oversold since Spring/Summer 08, they are currently undervalued, sentiment is very low, but users (commercial users) of natural commodities are aggressively buying. These are perfect setup conditions and opportunities to enter long assuming the proper entry conditions are also met (in addition to the setup conditions). For now, we are still waiting to see what happens this week.

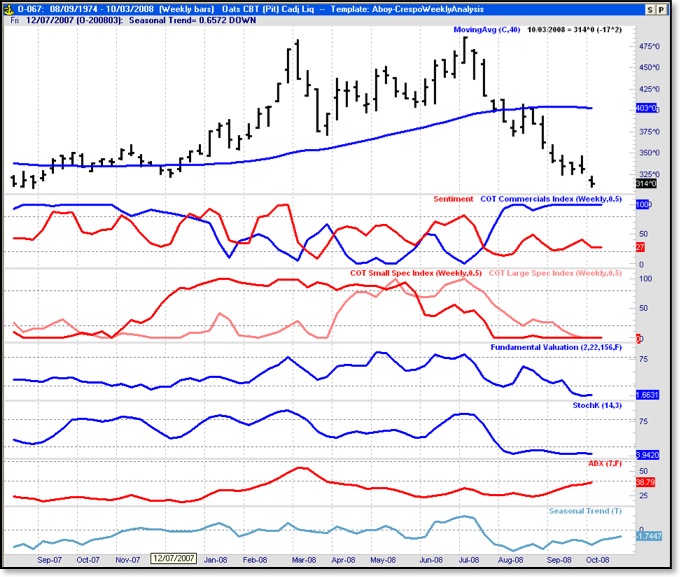

Follow-up on previous week setups

October/12/2008 20:01

Last week we analyzed three commodities: Oats, Platinum, and Wheat. The setup conditions are still valid for Oats and Wheat. Both of these commodities are still in a downtrend but it looks like a reversal may be near. We need to be ready with our daily entry technique to profit once the reversal occurs. In the case of Platinum, it is interesting that the commercials are significantly less bullish now (51.99%) and that the large traders have started to have interest in this commodity (61.3% bullish). We need to keep an eye on it but it is starting to deviate from our optimal setup conditions that we like to see before considering a long position.

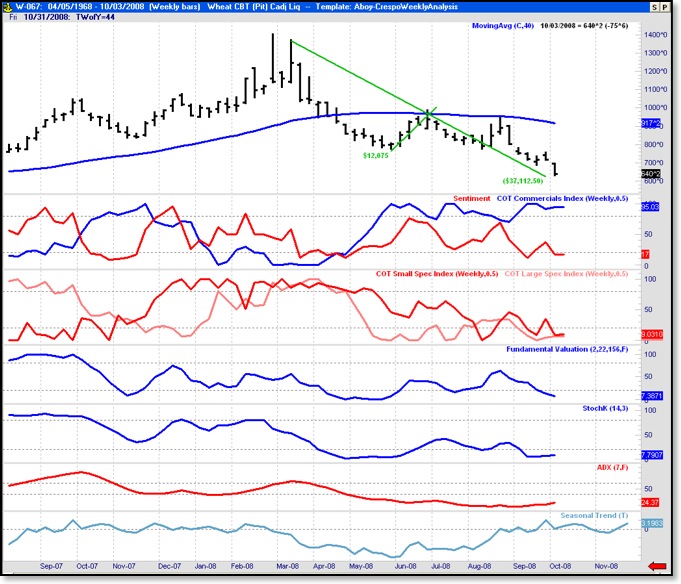

Setup Condition for Wheat (October 08 W2)

October/05/2008 20:11

This grain commodity exhibits very good setup conditions for the second week (W2) of October. The public and brokers sentiment is very low, the large commodity traders and funds are heavy sellers, and the small traders are very short. Our position is always contrarian to what the public is doing, to what the brokers are recommending in their newsletters (in this case they are recommending to sell wheat), and to what the small speculators are doing (currently heavy sellers). In summary, the basic setup conditions are:

Conditions:

-Commercials: high > 80%

-Sentiment: low < 20%

-Large Traders: low <20%

-Small Traders: low < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: uptrend

-ADX: low < 20%

Analysis:

-This commodity exhibits excellent setup conditions for an uptrend but we also need to wait for the right entry. The commercials are bullish, the commodity has been oversold as seen by the stochastic (it has lost $37,000 per contract since March 08), it is fundamentally undervalued at the moment, the ADX indicates a downtrend that lacks integrity, and the seasonal tendency is favorable. In summary, we have excellent setup conditions for Wheat. This is definitely a commodity we need to follow very closely during the upcoming second week of October (October W2) and have our entry technique ready to jump in.

Conditions:

-Commercials: high > 80%

-Sentiment: low < 20%

-Large Traders: low <20%

-Small Traders: low < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: uptrend

-ADX: low < 20%

Analysis:

-This commodity exhibits excellent setup conditions for an uptrend but we also need to wait for the right entry. The commercials are bullish, the commodity has been oversold as seen by the stochastic (it has lost $37,000 per contract since March 08), it is fundamentally undervalued at the moment, the ADX indicates a downtrend that lacks integrity, and the seasonal tendency is favorable. In summary, we have excellent setup conditions for Wheat. This is definitely a commodity we need to follow very closely during the upcoming second week of October (October W2) and have our entry technique ready to jump in.

Setup Condition for Platinum (October 08 W2)

October/05/2008 14:52

There is a potential market setup that may develop in the next couple of weeks for PLATINUM:

Conditions:

-Commercials: moderate after having been long

-Sentiment: low < 20%

-Large Traders: moderately short

-Small Traders: low short < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: neutral and uptrend to develop

-ADX: very high > 60%

Analysis:

-This is a metal commodity we need to keep an eye on. It lost $61,030 per contract since May 23, 2008. The ADX indicator still shows integrity on the downtrend but its high value indicates a trend reversal may be near. We need to wait for the ADX indicator to reach a maximum and initiate the reversal. This is a commodity to keep in the watch-list for the intermediate future. Depending on the general market and economic conditions it may be an opportunity to make a substantial amount of money per contract but we first need to way for the ADX and price reversal to enter. The current margin requirements are $2,160.00. At the moment, however, the COT data and ADX does not confirm it yet.

Conditions:

-Commercials: moderate after having been long

-Sentiment: low < 20%

-Large Traders: moderately short

-Small Traders: low short < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: neutral and uptrend to develop

-ADX: very high > 60%

Analysis:

-This is a metal commodity we need to keep an eye on. It lost $61,030 per contract since May 23, 2008. The ADX indicator still shows integrity on the downtrend but its high value indicates a trend reversal may be near. We need to wait for the ADX indicator to reach a maximum and initiate the reversal. This is a commodity to keep in the watch-list for the intermediate future. Depending on the general market and economic conditions it may be an opportunity to make a substantial amount of money per contract but we first need to way for the ADX and price reversal to enter. The current margin requirements are $2,160.00. At the moment, however, the COT data and ADX does not confirm it yet.

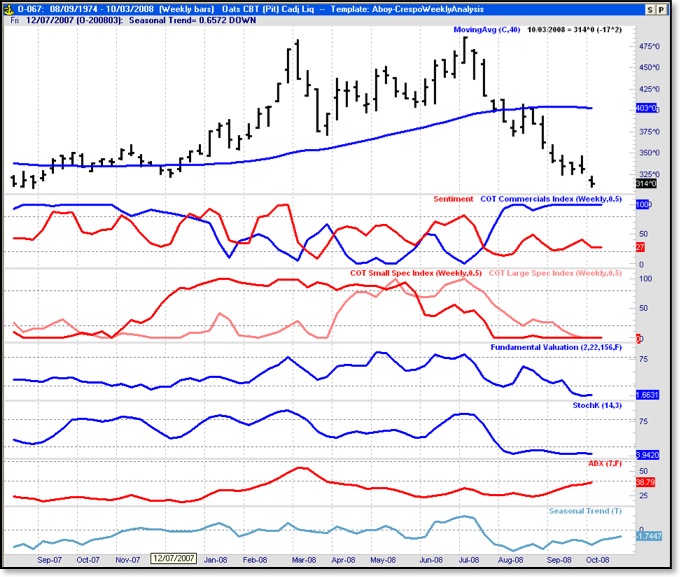

Setup Condition for Oats CBT (October 08 W2)

October/05/2008 14:18

There is a good market setup developing for OATS this week:

Conditions:

-Commercials: very long > 80%

-Sentiment: moderately low ~ 25%

-Large and Small Traders: very short < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: uptrend

Analysis:

-The ADX indicator still shows integrity on the downtrend. We need to wait for the ADX indicator to reach a maximum and initiate the reversal. Then it will be a good buying with the appropriate entry technique. This is a commodity to keep in the watch-list for the near future.

Conditions:

-Commercials: very long > 80%

-Sentiment: moderately low ~ 25%

-Large and Small Traders: very short < 20%

-Fundamental valuation: undervalued <20%

-Stochastic: oversold <20%

-Seasonal: uptrend

Analysis:

-The ADX indicator still shows integrity on the downtrend. We need to wait for the ADX indicator to reach a maximum and initiate the reversal. Then it will be a good buying with the appropriate entry technique. This is a commodity to keep in the watch-list for the near future.