Investment

Actual Trade Results based on AboySetup1 (COT Proxy)

May/31/2009 22:51

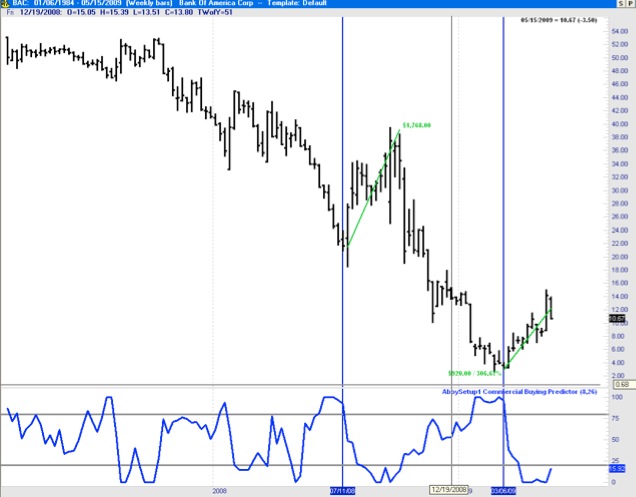

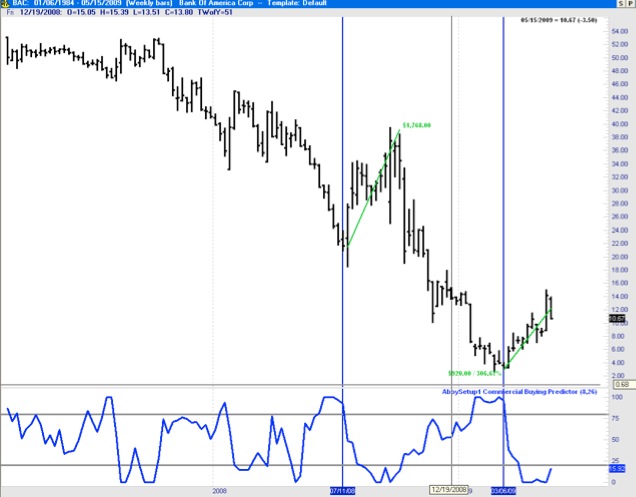

I have been using the AboySetup1 Commercial Buying Predictor (COT Proxy) to guide actual stock trades. Below are the results of a sample real trade (entry during the first week of March and exit the first week of May).

SCREENSHOTS WITH ACTUAL RESULTS: BAC (268.10%), GE (106.62%), CAT (58.07%)

BANK OF AMERICA (BAC): March to May. Actual Realized Gain: 268%

GENERAL ELECTRIC (GE) : March to May. Actual Realized Gain: 106.62%

CATERPILLAR (CAT) : March to May. Actual Realized Gain: 58.07%

SCREENSHOTS WITH ACTUAL RESULTS: BAC (268.10%), GE (106.62%), CAT (58.07%)

BANK OF AMERICA (BAC): March to May. Actual Realized Gain: 268%

GENERAL ELECTRIC (GE) : March to May. Actual Realized Gain: 106.62%

CATERPILLAR (CAT) : March to May. Actual Realized Gain: 58.07%

Follow-up on Anounced Choices

May/30/2009 00:11

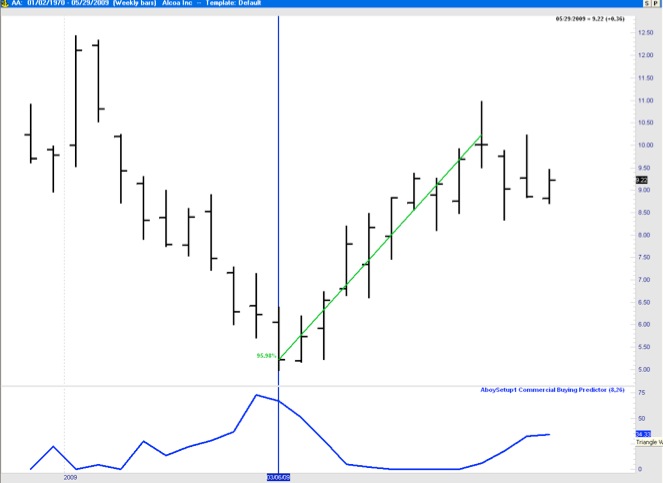

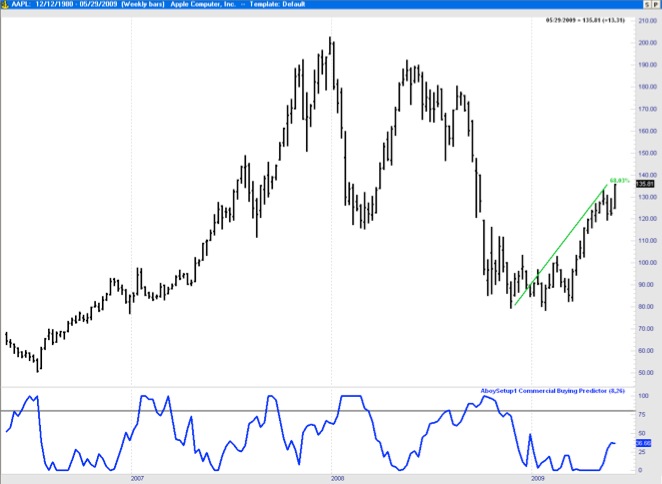

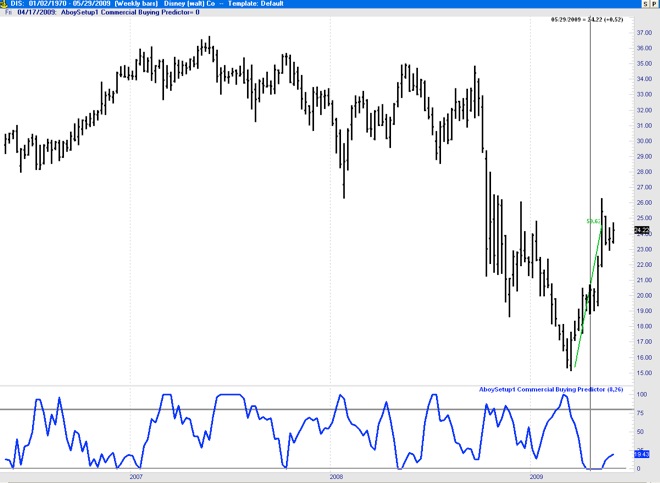

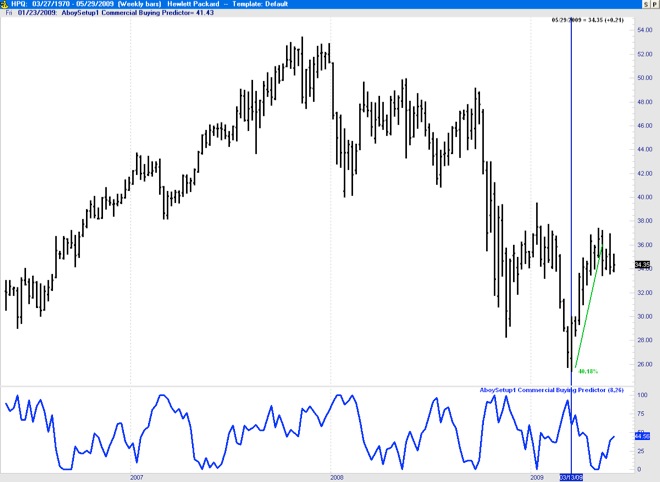

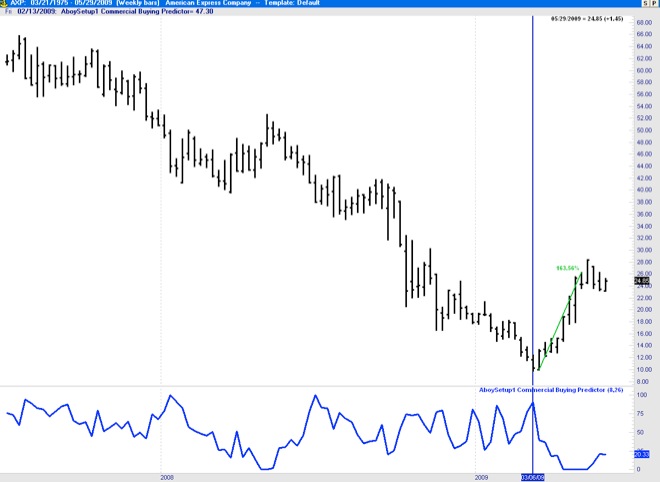

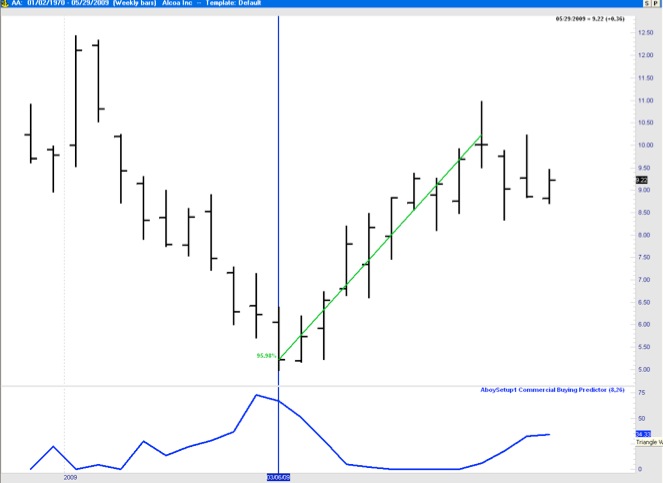

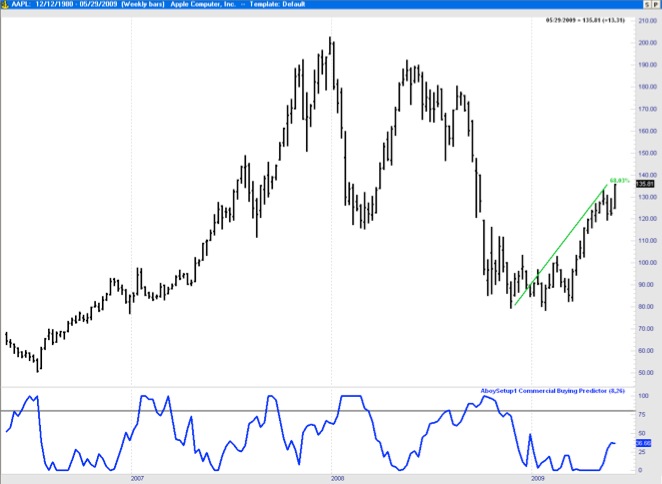

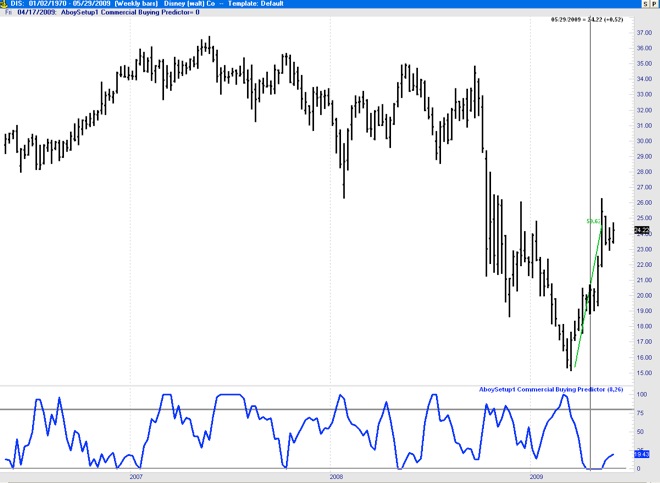

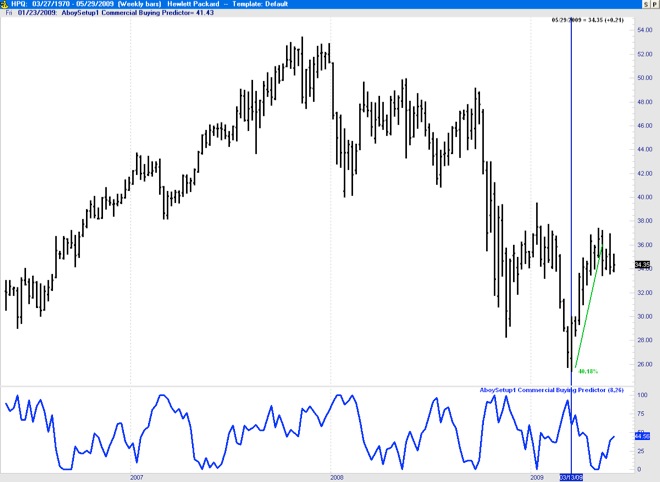

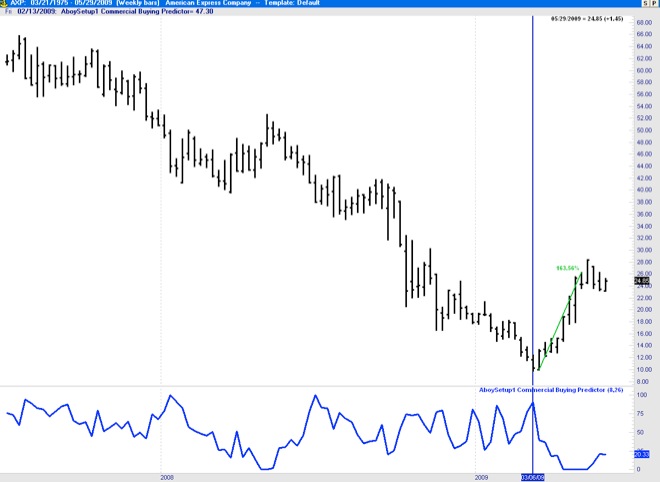

Back in October I selected GE, DIS, HPQ, AXP, and AA as the stocks with potential for beating the Dow Jones this year. As always we must wait to enter until the setup conditions are met at least based on the AboySetup1 Commercial Buying Predictor - COT Proxy (see other posts for specifics about this proprietary indicator) and confirmed by others such as the ADX. Based on the S&P500 seasonality, good entries typically happen in October or March. This year, however, the setup conditions for Long Entry were not meet until the first week of March (for most of them, see charts below) and Exit setup conditions took placed in the first week of May (which is also a good exit month based on seasonality). Here is a report with the results based on two months in the market: AA (95%), DIS (52%), HP (42%), AXP (163%), GE (106%).

ALCOA (AA): 95.98%

APPLE (AAPL): 68.03%

DISNEY(DIS): 52%

HEWLETT PACKARD (HPQ): 40.18%

AMERICAN EXPRESS COMPANY (AXP): 163%

ALCOA (AA): 95.98%

APPLE (AAPL): 68.03%

DISNEY(DIS): 52%

HEWLETT PACKARD (HPQ): 40.18%

AMERICAN EXPRESS COMPANY (AXP): 163%

DJ Investment Choices 2008-09

October/12/2008 00:40

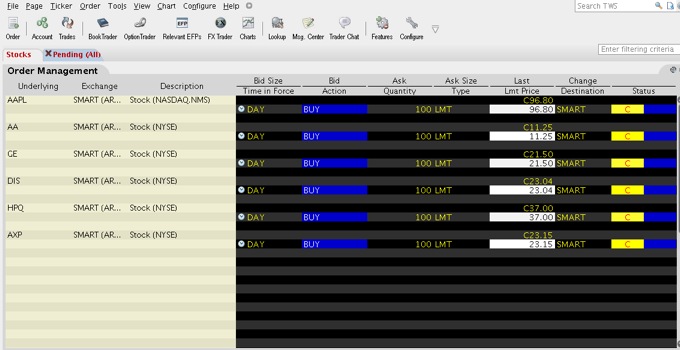

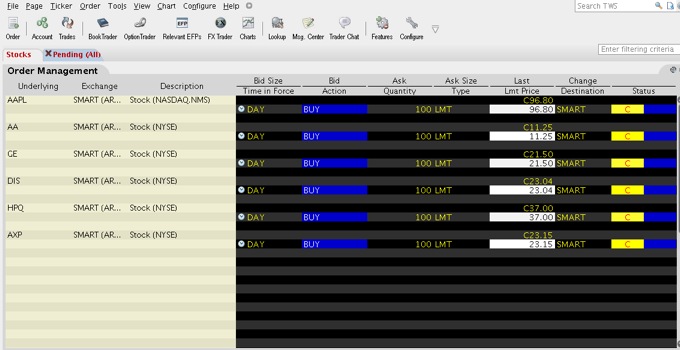

In October 2, 2008 I advanced my selection of the 5 Dow stocks that I think have potential for beating the Dow index this year (quite hard to do). Below is the current prices of these stocks (AA, GE, DIS, HPQ, and AXP). As I mentioned on the original post we need to wait for indications of a reversal but for the purposes of comparison against the index we can enter at any time. Below is a screenshot of TWS with the limit orders showing specific prices based on the close price on Friday. Obviously, it is somewhat dangerous entering right now and I wouldn’t recommend it until the technical indicators show signs of a reversal.

Note also this site focuses on commodities and evaluation of trading strategies and not stocks for investment (especially with holding times > 6 months). We are advancing this info to test a stock selection algorithm based on fundamental valuation.

Note also this site focuses on commodities and evaluation of trading strategies and not stocks for investment (especially with holding times > 6 months). We are advancing this info to test a stock selection algorithm based on fundamental valuation.

Stock Investment Choices for 2008/09

October/02/2008 23:29

This year has been one of the worst financial years in history. We are going through the worst credit crisis since The Great Depression and a historic Housing Market Crash. At the moment of this writing both the major indices and the vast majority of stocks are still in a major downtrend. This is very much a significant bear market.

While it is not the objective of this site to pick investment stocks, once a year we will select a set of 5 investment stocks to hold of for approximately 6-7 months. The selection is based on a proprietary stock selection algorithm based on valuation that I’m currently testing. The purpose of this blog entry is to “keep me honest” six months from now.

Here are my top-5 Dow stock picks.

-Alcoa (AA)

-General Electtric (GE)

-Walt Disney (DIS)

-Hewlett-Packard (HPQ)

-American Express (AXP)

Note: At the moment all these stocks are in a significant downtrend. The ADX still shows significant integrity to the downtrend. We need to wait for a reversal and use an appropriate entry technique.

This portfolio should be re-evaluated at the beginning of the month of May 2009. The benchmark for this portfolio is the Dow Jones Industrial. We should compare the performance of these 5 stocks combined as a single portfolio against the Dow 30 exiting from the positions in early May.

While it is not the objective of this site to pick investment stocks, once a year we will select a set of 5 investment stocks to hold of for approximately 6-7 months. The selection is based on a proprietary stock selection algorithm based on valuation that I’m currently testing. The purpose of this blog entry is to “keep me honest” six months from now.

Here are my top-5 Dow stock picks.

-Alcoa (AA)

-General Electtric (GE)

-Walt Disney (DIS)

-Hewlett-Packard (HPQ)

-American Express (AXP)

Note: At the moment all these stocks are in a significant downtrend. The ADX still shows significant integrity to the downtrend. We need to wait for a reversal and use an appropriate entry technique.

This portfolio should be re-evaluated at the beginning of the month of May 2009. The benchmark for this portfolio is the Dow Jones Industrial. We should compare the performance of these 5 stocks combined as a single portfolio against the Dow 30 exiting from the positions in early May.